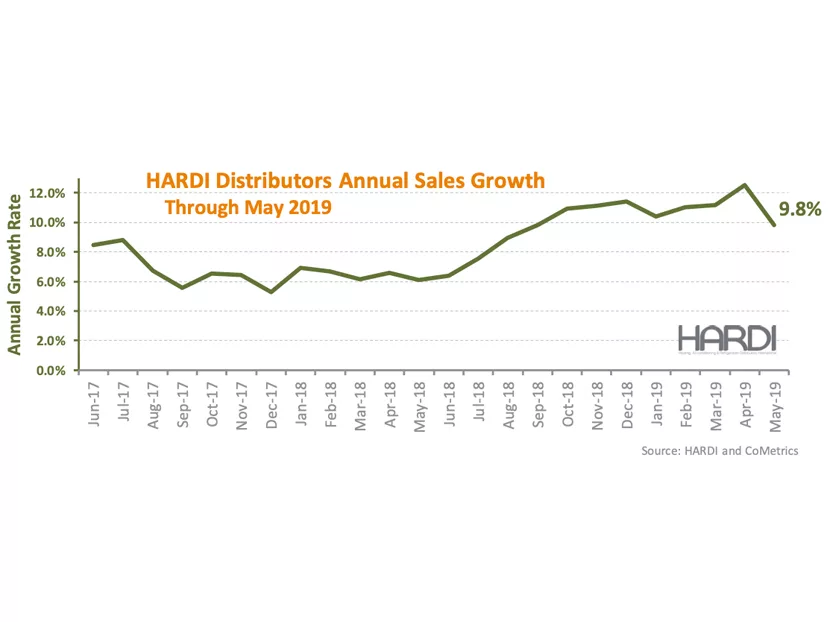

Heating, Air-conditioning & Refrigeration Distributors International (HARDI) released its monthly TRENDS report, showing average sales growth by HARDI distributor members declined by 1.9 percent in May 2019.

The average annualized sales growth for the 12 months through May 2019 is 9.8 percent.

“Given the challenges this month, I think a sales dip of only 2 percent is quite an achievement,” said HARDI Market Research and Benchmarking Analyst Brian Loftus. “Most regions had very difficult sales comparisons versus May of 2018 that was much warmer than normal in many regions, and there was excessive precipitation this May across the Central and Southwest regions.”

The days sales outstanding (DSO), a measure of how quickly customers pay their bills, is unusually low for this time of year. “DSO usually increases this time of year as cooling season gets rolling,” said Loftus. “May was cooler than normal in the Northeast, Central and Western regions. Then all the rain in the Central and Southwest regions interfered with activities. June will likely be closer to normal and so will the DSO.”

“The annual growth rate was in double-digit territory from October 2018 through April 2019, but that will be difficult to preserve through the second half of the year,” said Loftus. Job growth is slowing, residential permits peaked last summer and are down 2 percent, existing home sales are down by nearly 4 percent, the latest Conference Board’s June Consumer Confidence Index experienced the largest one-month decline since 2015, and the ABI is struggling to stay in the expansion territory above 50. “An unusually warm summer can stimulate enough demand to offset any easing of the pace of economic growth,” said Loftus.

HARDI members do not receive financial compensation in exchange for their monthly sales data and can discontinue their participation without prior notice or penalty. Participation is voluntary, and the depth of market coverage varies from region to region. An independent entity collects and compiles the data that can include products not directly associated with the HVACR industry.