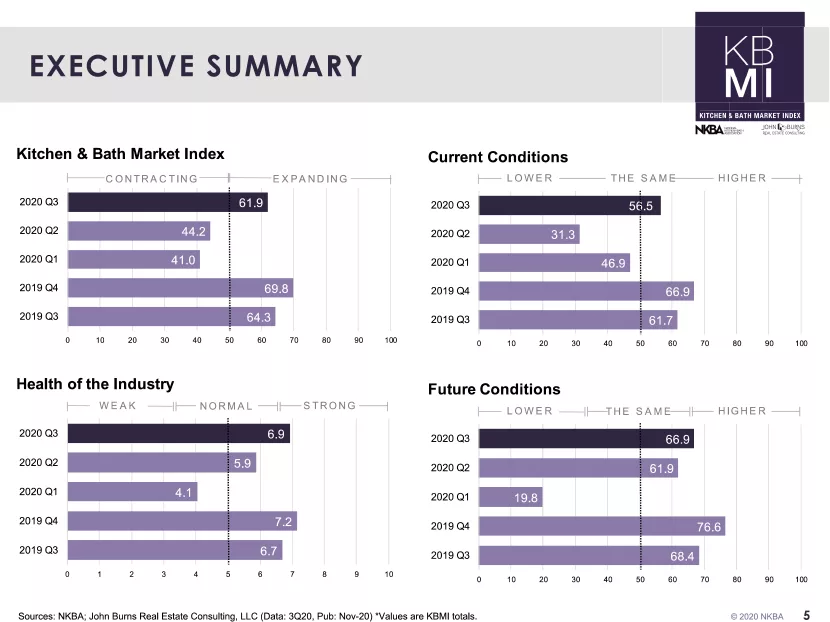

The National Kitchen & Bath Association (NKBA) and John Burns Real Estate Consulting (JBREC) have released their Q3 2020 Kitchen & Bath Market Index (KBMI). For the first time this year, the KBMI is above 50 — at 61.9 — up from 44.2 in Q2 and 41 in Q1. Scores of 50 indicate expansion and scores below indicate contraction.

NKBA members rank the overall health of the industry at 6.9 (on a scale of one to 10), just below the 7.2 reported in pre-COVID Q4 2019. While confident about current business conditions at 56.5, industry members are even more optimistic about future conditions, which they set at 66.9 as 2020 draws to a close.

"As we approach the end of an unprecedented year, the industry outlook is promising," said NKBA CEO Bill Darcy. "While COVID-19 will continue to present challenges to the supply chain, labor and spending, we're grateful to be one of a few industries that has actually seen growth in response to consumers spending more time at home and looking to make their spaces more functional in this new normal. Kitchen and bath professionals are well-positioned for continued success into the coming year."

"Consumers have undertaken a lot of remodeling in 2020, but significant opportunity remains, especially for the kitchen and bath market, going into 2021," noted Todd Tomalak, principal at JBREC. "Much of the already completed renovation work has focused outside the home — redoing decks, gardens and outdoor entertaining spaces — in response to COVID-19 restrictions. For many families working and schooling from home, 2020 wasn't the ideal time to redo a space as essential as the kitchen or bathroom. As such, we anticipate continued activity for kitchen and bath remodeling next year."

In the first half of 2020, NKBA members predicted negative sales for the year, but Q3 brought better news for the industry, which now expects a 1.1% increase in YOY sales compared to 2019. In fact, Q3 sales in 2020 were up 2.1% from 2019, and sales grew 5.9% since last quarter overall — ranging from designers, who saw a smaller 3.2% increase, to manufacturers, who experienced a significant 9.6% rise.

More than half (62%) of all companies surveyed report COVID-19 drove higher demand to their business in Q3. While the crisis continues to have some adverse effect on the industry, with 29% reporting the pandemic has led to lower demand, its negative impact has lessened each quarter and, at 5.9 (on a scale of one to 10), is nearly 30% lower than the Q1 rating of 8.1. Among those industry professionals who haven't seen demand return to normal levels, 29% expect it to do so in 2021.

The following trends are expected to impact homeowners and the industry into 2021:

- For the first time, supply chain disruption is reported as the industry's greatest challenge, beating out economic uncertainty and recession and further hinting at an optimistic outlook for 2021 as manufacturers ramp up production in response to demand. Appliances and cabinets are most impacted, while other luxury products, particularly from Europe, are facing delays in lead times and backorders as well.

- Increased pipeline demand is another promising indicator for 2021, with 53% seeing larger pipelines of projects or project orders in Q3 2020 compared to the same period in 2019.

- Still, uncertainty remains. When asked if they think COVID-19 will "shut down" the economy again in Q4, 39% of NKBA members are unsure. Almost the same percentage (37%) do not expect another shutdown, but 24% do anticipate shutdowns as infection rates climb.

- Despite strong remodeling interest, consumers are still more price-conscious than they were pre-COVID, with designers especially noting smaller budgets. Customers are leaning toward smaller-scale remodels and temporary solutions that are low-cost and largely DIY.

Each sector of the kitchen and bath market faces unique the following challenges and opportunities:

- Perhaps unexpectedly given COVID-19 restrictions, retail sales foot traffic rose 8% in 2020 over 2019. With much of the foot traffic driven by DIY'ers, the increase in foot traffic has not necessarily led to increased revenue.

- In response to a heightened demand for products, especially appliances, manufacturing sales increased 5.8% YOY in Q3, despite some COVID-19-related disruptions and difficulties finding qualified labor to meet ramped-up production needs. Manufacturers also rated the KBMI highest of any sector, at 67.7. The majority (55%) of manufacturers are back to operating at 100% or more of their normal workforce, with 14% employing more workers than pre-COVID.

- Lower price points and cutbacks in discretionary design services have propelled homeowners to DIY projects – but designers are seeing marked improvement in Q3, with more than half (57%) reporting higher bids in the last quarter than Q1 and Q2. Additionally, 39% reported no canceled or postponed projects in Q3.

- Building and construction companies also continue to see fewer postponements and cancellations, with 49% reporting zero of either in Q3. More than half (54%) of companies with postponed jobs expect those to resume in 2021.

To learn more about the National Kitchen & Bath Association and the Kitchen & Bath Industry Show, visit www.NKBA.org. To learn more about John Burns Real Estate Consulting, visit www.realestateconsulting.com.