Metals and Minerals Projects List PVF Among Key Needs

Battery and metal recycling project activity is also busy as companies build new or expand EV battery recycling plants.

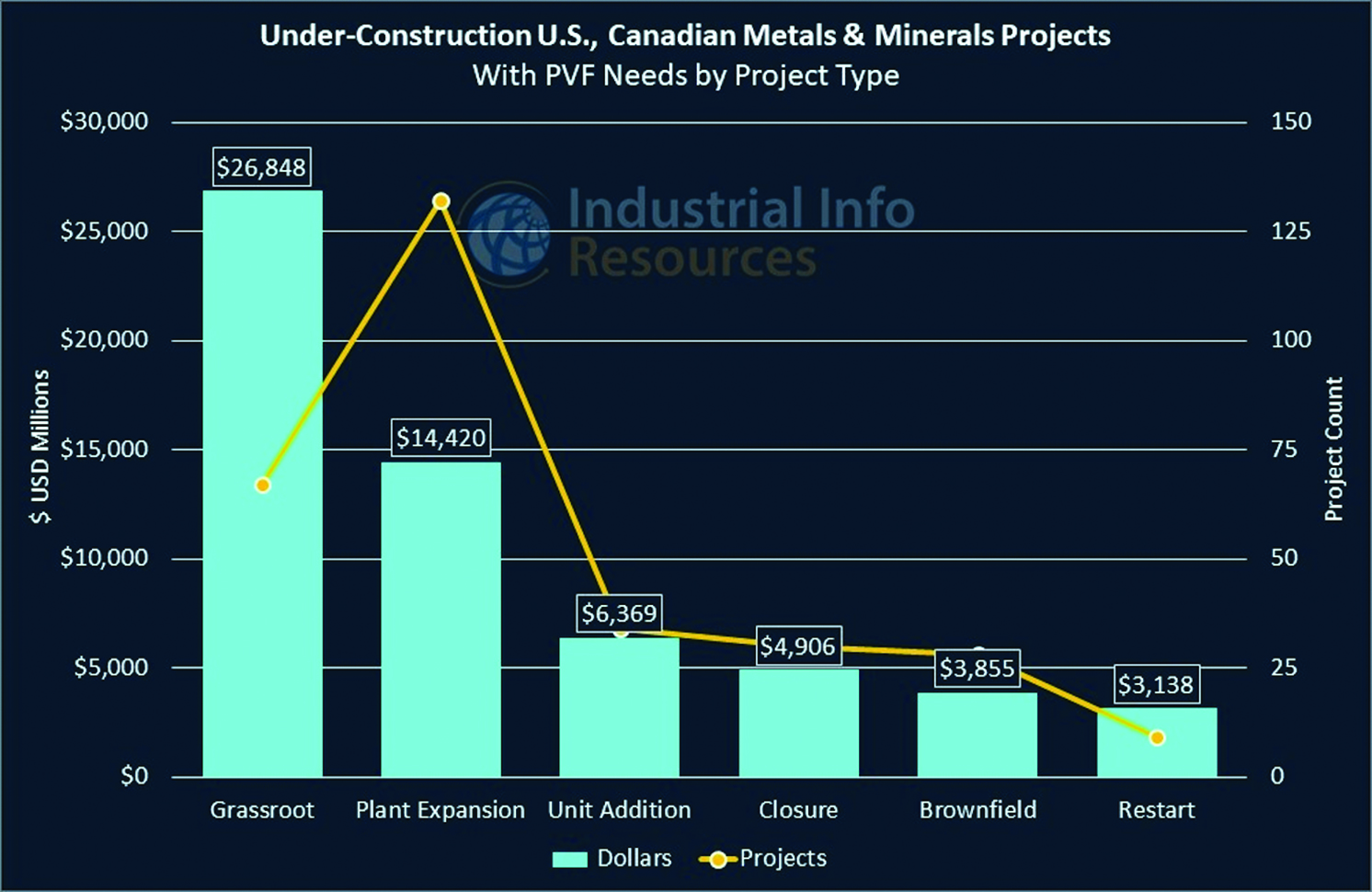

Pipe, valves and fittings (PVF) play a substantial role in the metals and minerals industry. In the United States and Canada, Industrial Info Resources (IIR) is tracking more than $69 billion worth of metals and minerals projects that list PVF among their key requirements (see Figure 1). These projects range from steel mills to potash mines.

Project activity remains robust and continues to rise this year, especially for energy transition and raw material security-related projects. They are being driven by increased government stimulus for lithium-ion battery supply-chain critical minerals and downstream processing.

Battery and metal recycling project activity is also busy as reflected in growth in the smelter sector. The drop in critical metal prices throughout most of 2023 has placed pressure on high-cost operations; the industry has experienced mining project delays as companies grapple with rising costs and permitting.

The drive to carbon neutrality has sparked much of the project activity in North America. Environmental, social and governance (ESG) issues command a lot of attention. Most ESG-driven projects involve greenhouse gas emission-reduction projects, including carbon capture and storage at cement plants and renewable energy projects. Recycling of lithium-ion batteries to recover valuable critical minerals drives about $6 billion worth of projects.

Mining Sector: Critical Minerals

Government stimulus in the form of the U.S. Infrastructure Investments and Jobs Act and the Inflation Reduction Act will continue to drive project activity. Mining companies try to balance productivity goals while prioritizing investments in critical minerals and decarbonization to take advantage of grants and loans provided by the U.S. Department of Energy.

Also, the U.S. Department of Defense granted more than $327 million to critical minerals projects involving lithium, graphite, anode production, battery recycling, cobalt, rare earths, antimony, and nickel mining and production. A $1.5 billion Critical Minerals Infrastructure Fund has been set up in Canada.

The mining sector is developing mines that will bring more critical minerals to market as fast as possible, given that it takes 8 to 10 years to develop a mine. Mining companies are committed to reducing their carbon footprints by adding solar or wind energy and the electrification of large vehicle fleets. Steel and mining companies are evaluating the use of green hydrogen to decarbonize production processes as well as fuel for large mining trucks.

Steel Sustainability Efforts

Steel companies search for ways to clean up the manufacturing process and increase the use of renewable energy. Low-emissions steel products are one of the fastest moving parts of the industry as the auto industry and original equipment manufacturers seek a cleaner product.

While not yet in North America, steel companies overseas are studying ways to make green hydrogen steel, which can make the steelmaking process almost carbon-free. Green hydrogen steel is made by using hydrogen created from water electrolysis and powered by renewable energy.

Other steel sustainability efforts include carbon capture and energy-efficiency projects such as off-gas heat recovery, burner improvements and scrap preheating alternatives. At least two big U.S. steel companies are committed to reducing greenhouse gas emissions by 2030, working toward net-zero emissions by 2050.

Population growth, rising investments in infrastructure development (rebar) projects, and energy transition (doubling the grid by 2050) will keep demand steady in the United States and Canada. Steel is currently the third-largest sector, with $31 billion in active projects in North America. The World Steel Association forecasts that global steel demand will increase by 1.9 percent in 2024, reaching 1.85 billion metric tons.

Mining Sector: Electric Vehicles

Mining companies continue to diversify their portfolios to include rare earths and other critical minerals that can be used in the production of electric vehicle (EV) battery materials, such as anodes and cathodes.

Plants producing anodes, cathodes and precursor materials cannot come online fast enough. Many startup companies hope to cash in on government incentives to supply critical battery metals for EVs and battery storage systems by building new plants in the same areas where battery plants are located to create a seamless supply chain.

Over the last three years, Korean battery makers and automakers have announced U.S. investments of more than $20 billion, including nine battery factories and an auto plant in Georgia. These factories will require battery materials as well as recycling spent batteries.

The rise of the EV market continues to drive the smelting market. Most of the project spending is related to maintaining production equipment (furnace rebuilds) and building new or expanding battery recycling plants. Companies are adding more battery-grade lithium hydroxide capacity (a precursor for cathode materials) by investing more than $2 billion in grassroot projects, unit additions and plant expansions.

Gypsum, Cement and Glass

With the anticipated upward trend of construction infrastructure projects and remodels, gypsum companies are investing in expanding capacity, updating equipment, and adding recycling and heat recovery technology to meet new ESG standards. A lot of capacity is coming online in Canada — particularly in the provinces of Alberta, Ontario and Quebec — to help combat the housing shortage. Ontario’s target is to build 1.5 million new homes by 2031.

In the United States, more capital is being spent to increase capacity in the South, where the demand for gypsum wallboard is directly related to the growth of the construction sector, especially the commercial and housing sectors.

Cement is the backbone of the construction industry, but the manufacturing process is carbon-intensive. Cement manufacturers are spending millions to add carbon-capture technologies to existing facilities, with many more sites being evaluated. Several companies are also evaluating methods of producing low-carbon cement to meet future demand while still committing to decarbonization.

Glass plants are expected to have steady growth despite an uptick in closures. These plant closures are not reflective of glass demand but out of a need to remove outdated, older plants beyond updating. This will free up capital for modernizations, adding emission control equipment and furnace rebuilds.

Grassroot projects will cater to increased demand in food and beverage, medical, power (solar) and telecommunications industries. Glass manufacturers are also looking for ways to cut costs, maintain the efficiency of existing equipment and reduce their environmental footprints.

Brian Ford is editor in chief at Industrial Info Resources and has been with IIR since 2014. With global headquarters in Sugar Land, Texas, and 18 offices worldwide, IIR is a provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. To contact IIR, visit www.industrialinfo.com or call 713-783-5147.